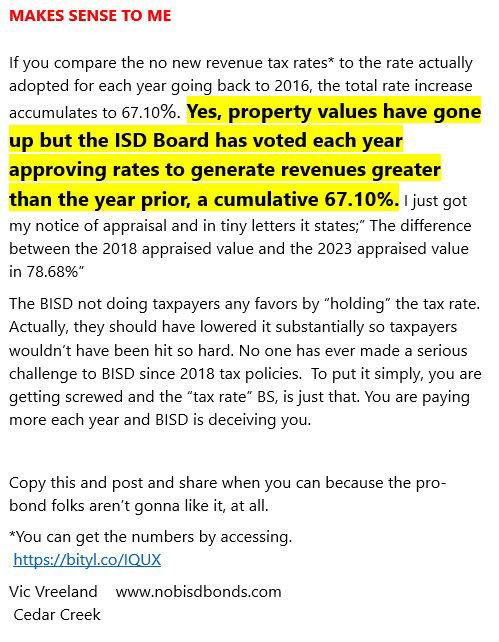

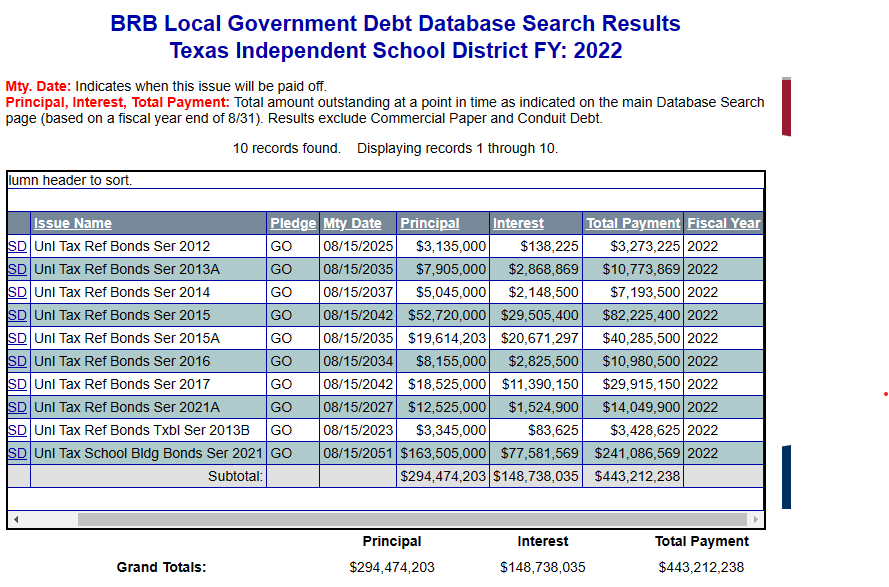

Even thought the tax rate has not changed - Your BISD tax amount will go up. It is a trick BISD Board has been playing on your for years

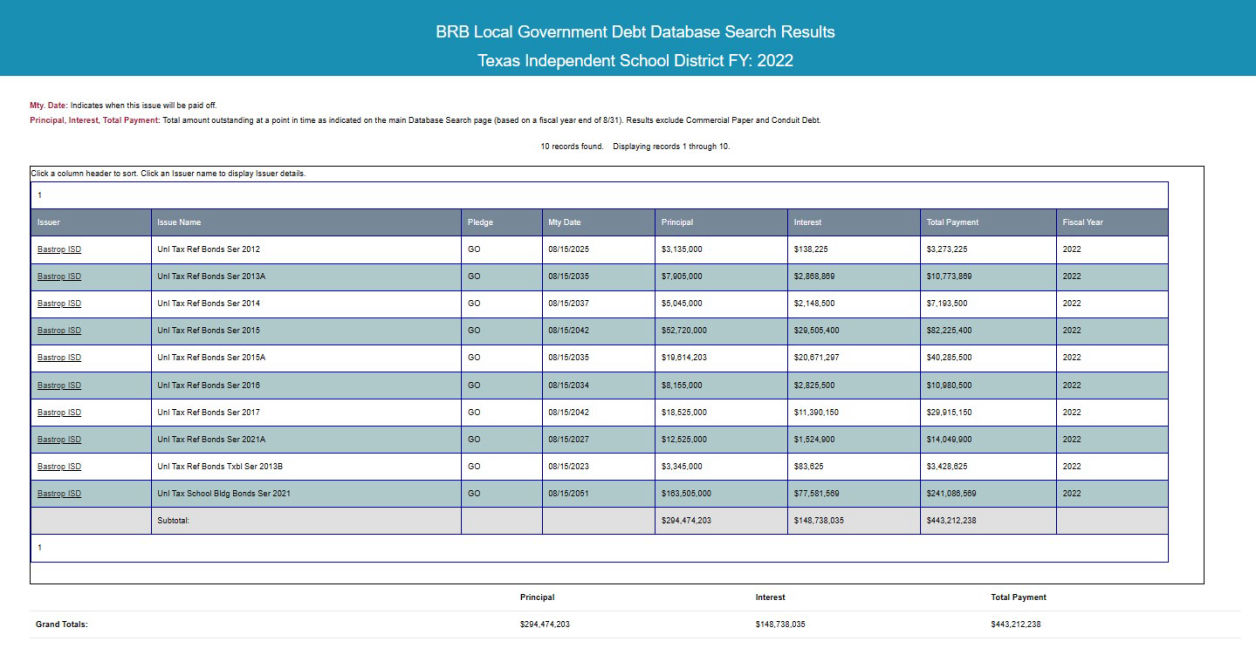

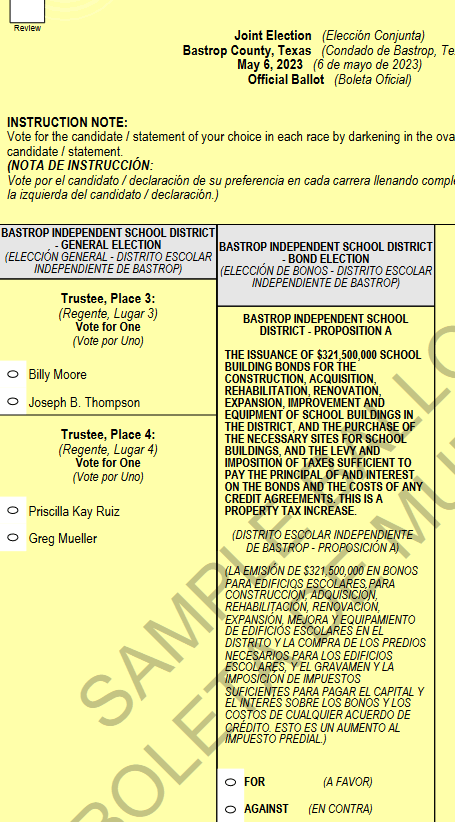

When the new debt is released, BISD (You and me) will be in hock for over a BILLION dollars. With home prices falling, it would be safe to say the rate would go up. At any rate, BISD is punishing you each and every year.